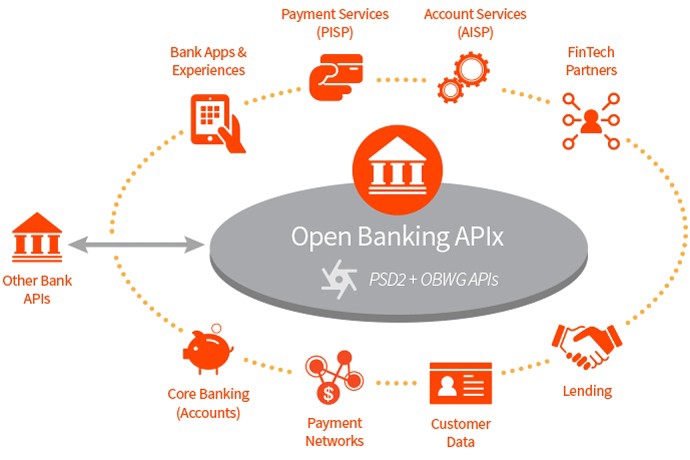

Open banking is a banking practice that allows the interchange of accounts and data across financial institutions, third-party service providers, and technical providers enabling them to transparently and securely exchange data to their consumers’ benefit. In simpler terms, open banking is reforming the banking industry by encouraging data sharing between banks and non-banks. It means that banks are required to open up their data channels to third parties and share consumer data with them when requested by users. Importantly, open banking enables users to know who has access to their data and permits them to allow or deny access to their financial data. Open banking raises the gains to consumers by bringing competition to the market, which encourages institutions to deliver better value and create innovative services. Companies that offer open banking services build and maintain the digital networks that allow data and payments to be securely requested from financial institutions. These companies can be authorized as either one of or both of the following:

1. Payment Initiation Service Providers, aka PISPs, as third parties that are licensed to initiate payments into or out of a consumer’s account;

2. Account Information Service Providers, aka AISPs, as third parties that are accredited to retrieve consumer‘s account data provided by financial institutions to share it with third parties on behalf of the user.

What AISPs do?

AISPs can analyze consumers’ account data, such as transactions, balances, direct debits, standing orders, etc., to provide users with insights into their financial behavior and control of their financial data. Also, AISP can analyze a single payment account or aggregate information from several accounts. Most importantly, as mentioned above, AISP allows consumers to easily share their account data with other third-party providers on behalf of users. However, to retrieve consumer’s information, these third-party providers must have the permission of the individual or business before being able to access the data. So, consumers authorize an AISP to access information from their accounts. AISPs handle customer consents needed to access Open Banking data and can see and share things like account balance and transaction history with other third parties with the user’s permission. However, AISPs are only allowed to obtain and collect payment account information but cannot initiate payments. In general, AISPs access and collect financial information from one or more of their consumers’ financial institutions with a user’s explicit consent and can display this data back to the customer or other institutions as instructed by the user.

How much does the AISP license cost?

Open banking allows sharing of financial information between financial institutions, usually banks, and third-party providers for the security of consumers and the development of financial products and services. Third parties that offer open banking services can be authorized as Payment Initiation Service Providers, so-called PISPs, and (or) Account Information Service Providers, aka AISPs.

To become an authorized AISPs, the company must comply with the rules set by the local Financial Supervisory Authority, or so-called FSA. If the only service that the company will be providing is account information services, it can apply to register as a Registered Account Information Service Provider, also known as RAISP. When applying for an AISP license, the company must pay an application fee to the FSA. Once the AISP license is provided, the company must pay an annual fee for continually carrying out account information services. The amount of this annual fee depends on the gross income that the company makes. In addition to the charges mentioned above, as an authorized AISP, the company is required to have insurance to cover liability claims or profit losses due to other reasons. Costs for insurance also can vary depending on many factors. An AISP license only allows access and collection of the information about the financial activity of the users and the presentation of that data with their explicit consent. So, if the company intends to provide account information services and other payment services, the application and authorization process will be more complicated and costly.

Leave a Comment